I was walking down Wall Street last week. It was 90 degrees and muggy, a moment of after-lunch calm. As I passed the historic, columned stock exchange I over heard a New York Tour Guide talking to a group of tourists.

Pointing to the facade announcing Owlet Baby Care’s IPO, she said: A baby went public today.

“A baby went public today.”

Not quite, but funny!! The connected nursery startup Owlet is 7 years old and now it’s a publicly listed newcomer on ‘the granddaddy of stock markets’.

I called out into the quiet street, ‘‘They make smart socks that measure blood oxygen and other vitals to alert you if your baby is in trouble.”

“Good to know,” a man in the tour group called back.

Seriously, this happened.

A spunky JLo could play me in the romantic comedy where a scene like this would be more likely to take place.

It is good to know.

Owlet says they’ve monitored the health of 1 million babies.

When Burc joined them in 2020, we discovered that unlike other startups both of us had worked with in San Francisco, Los Angeles, New York, and Istanbul, almost everyone we mentioned it to knew this Silicon Slopes Internet-of-Things (IOT) product. They had either used it with their own infants — some were on their third device — or had just gotten one for a coming birth, or had given one to a friend with a budding new family.

I waved and kept on walking. I was going to meet my husband and the president of Owlet around the corner before we were due to gather inside ‘the center of global financial markets’, the NYSE, for the closing bell ceremonies that mark the end of the day’s trading.

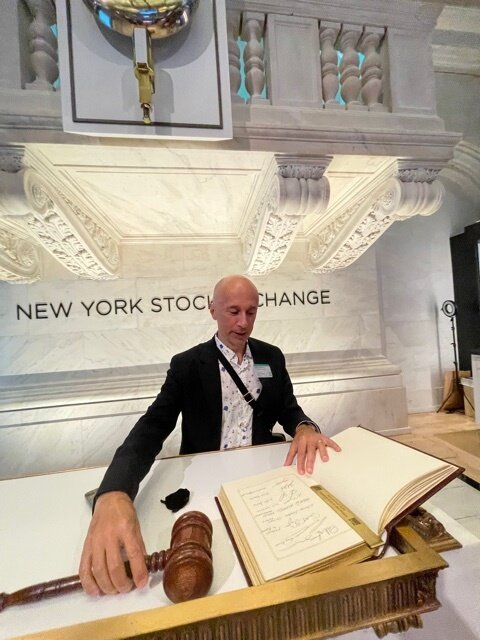

Photobombed by a Faberge urn

That urn over Burc’s shoulder — it was always in focus, he was blurry — was “produced by House of Faberge, gifted to the exchange by Czar Nicholas II of Russia in 1904 for listing a $1 billion bond issue”.

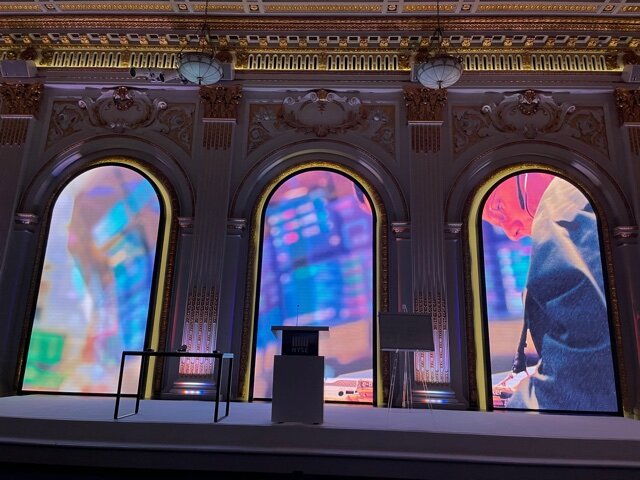

After passing stock exchange museum pieces at the entrance but not getting to look at them, like the original Thomas Edison stock ticker machines I noticed just at the elevator, we assembled in the classical revival Board Room that hosts world leaders, celebrities and business icons before heading down to the trading floor. There were cookies.

There was a short program about becoming listed on the exchange, a ceremony with a commemorative coin presentation by a stock exchange executive who joined the team on the balcony downstairs, and a speech by the CEO Kurt.

Congrats to my husband Burc Sahinoglu & everyone at Owlet Baby Care for going public as a unicorn (translation: that’s “a company with a $1+ billion valuation”) and for ringing the closing bell at NYSE last week!

It was a stellar New York summer day, finished by a cruise around the island getting to know Owlet founders, executives, family, board members, and investors, enjoying the sunset breezes over enduring landmarks and stunning new developments.

I’ve said it before and I’ll say it again, I love New York!